TRAVEL TAX EXEMPTION FOR BALIKBAYAN: OVERSEAS FILIPINOS, FORMER FILIPINOS, OVERSEAS FILIPINO WORKERS - YouTube

Overview of Tax Exemption Scheme for Nonresident Individuals and Foreign Corporations : Ministry of Finance

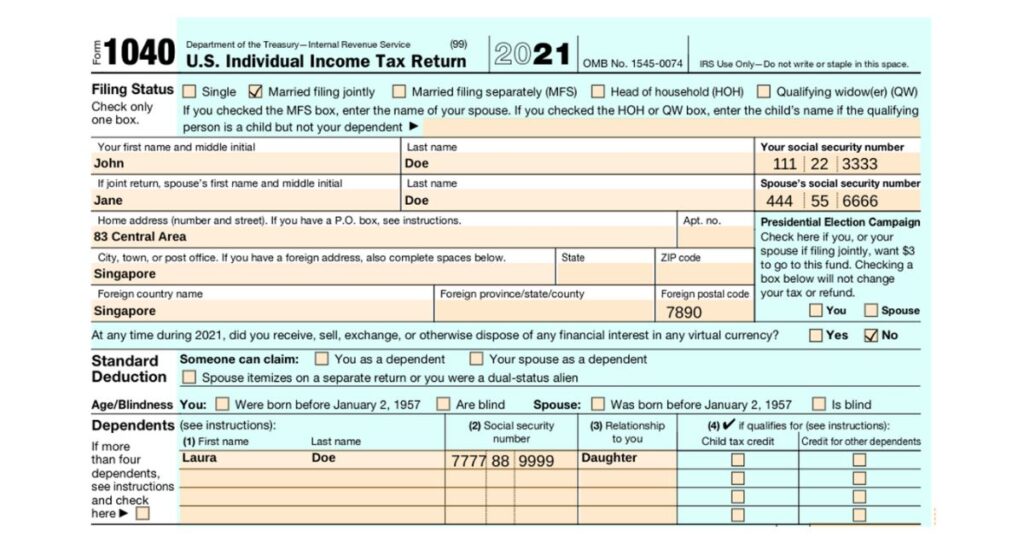

Publication 54 (2022), Tax Guide for U.S. Citizens and Resident Aliens Abroad | Internal Revenue Service