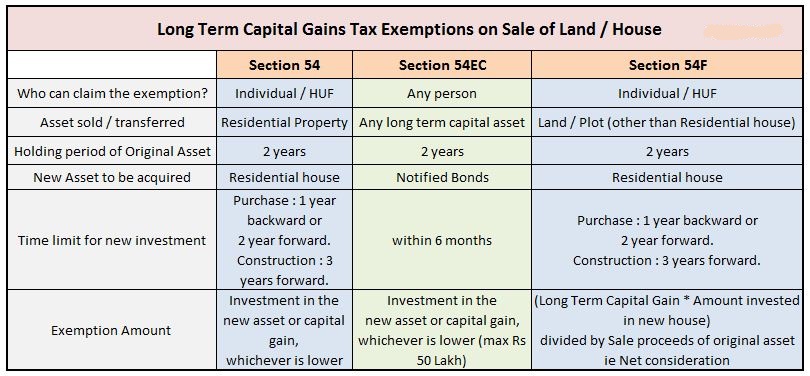

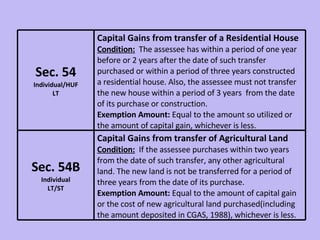

Income Tax Department, India - Section 54, 54EC, 54F: Exemption from Long Term Capital Gains Tax At the time of sale of any Long Term Capital Asset, the Gains are usually very

Husband entitled Capital Gain Exemption for asset bought in the name of the Wife: ITAT | A2Z Taxcorp LLP

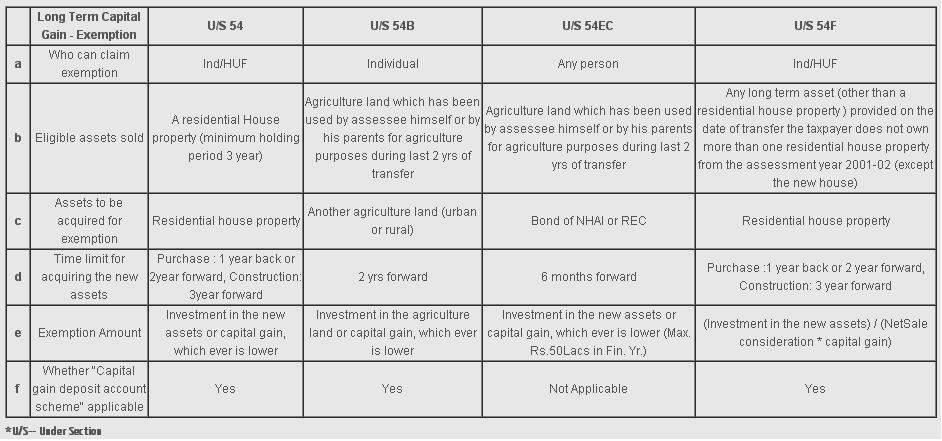

CAPITAL GAINS. INTRODUCTION CAPITAL GAINS “Any profit or gains arising from the transfer of capital assets is taxable under the head capital gains in. - ppt download

:max_bytes(150000):strip_icc()/over-55-home-sale-exemption2-46c8496917a1458b8583b6e8b8bc3800.jpg)