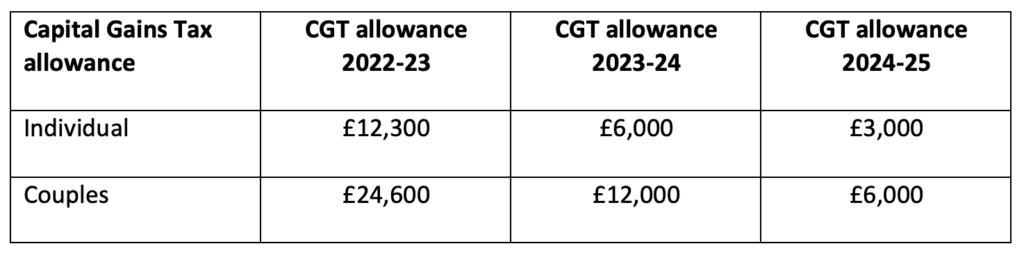

HM Treasury on X: "To restore public finances and make the tax system fairer, tax free allowance for capital gains will reduce in 2023--24 from £12,300 to 6,000 and again to 3,000

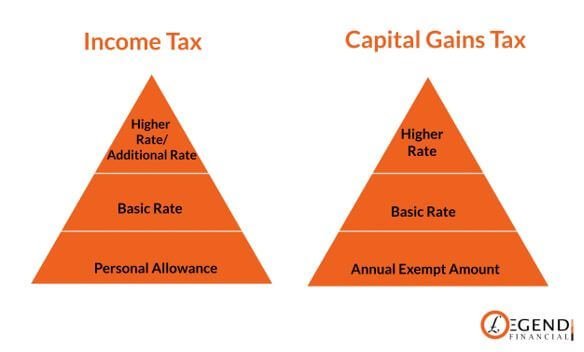

Tax After Coronavirus (TACs) : Reforming taxes on wealth by equalising capital gains and income tax rates

ExpertView: Cutting Capital Gains Tax allowance is yet another tax on landlords - Tenancy Deposit Scheme

Understanding the UK Capital Gains Tax Allowance Reduction and Its Impact on Crypto Investors | Recap Blog

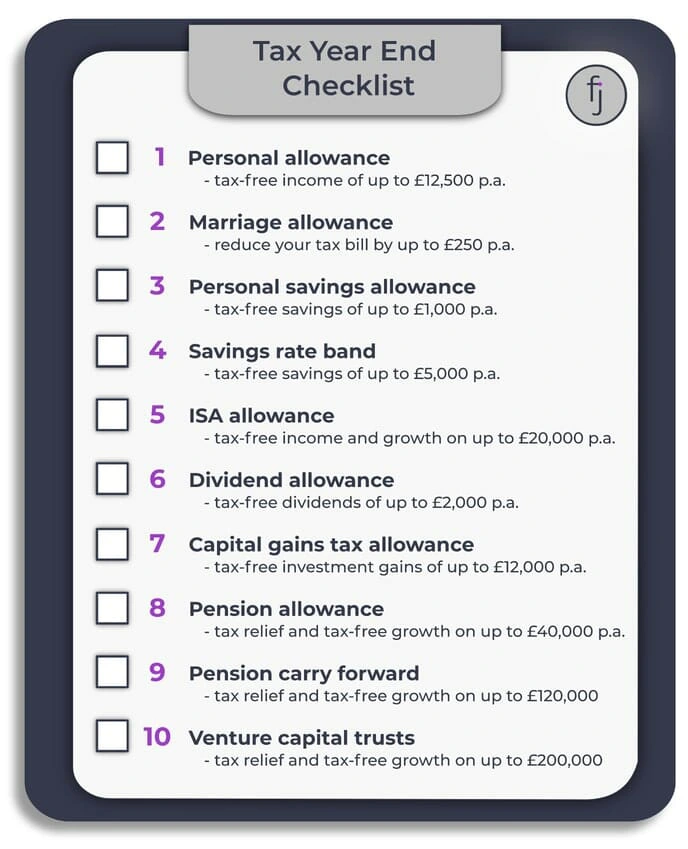

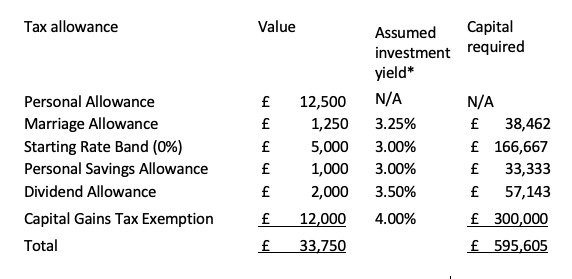

Maximising tax allowances - key ways clients may mitigate their outlay to HMRC - Professional Paraplanner

Capital gains tax allowance changes to hit half a million investors' profits as tax year begins - CityAM